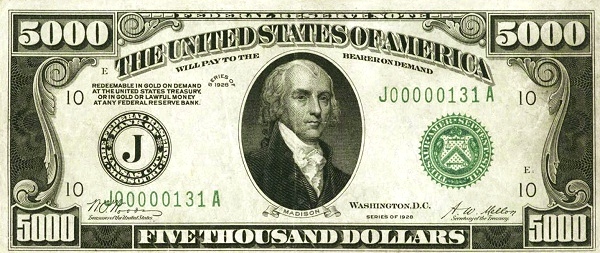

Life is unpredictable, and there may come a time when you need a substantial amount of money urgently, even if your credit history isn’t in the best shape. While having bad credit can make traditional borrowing options challenging, it’s not impossible to obtain $5,000 fast. In this article, we’ll explore some practical strategies to help you secure the funds you need, regardless of your credit score.

Explore Online Lenders

Online lending platforms have emerged as a viable alternative for individuals with bad credit. They often have more flexible lending criteria and offer personal loans that can be approved within a few business days. Research reputable online lenders, compare their terms, and choose one that suits your needs. Be prepared to provide documentation of your income and employment.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers directly with individual investors willing to fund loans. This can be a good option if you have a compelling loan request and a convincing story about why you need the money. Platforms like Prosper and LendingClub facilitate this type of lending.

Explore Credit Unions

Credit unions are not-for-profit financial institutions that often have more lenient lending criteria than traditional banks. If you’re a member of a credit union, inquire about their personal loan options. They may be willing to work with you even if your credit isn’t perfect.

Use a Co-Signer

If you have a trusted friend or family member with good credit, consider asking them to co-sign the loan for you. A co-signer agrees to take responsibility for the loan if you default, which reduces the risk for the lender and can help you secure a loan with better terms.

Consider a Secured Loan

Secured loans are backed by collateral, such as a car or valuable possessions. Because the lender has something to secure the loan against, they may be more willing to lend to individuals with bad credit. However, keep in mind that if you fail to repay the loan, you could lose the collateral.

Microloans and Payday Loans

While not recommended as a first choice due to their high-interest rates, microloans or payday loans can provide quick access to cash in emergencies. Be cautious and make sure you understand the terms and fees associated with these loans. Only use them if you have a clear plan to repay them promptly.

Improve Your Credit

While this won’t provide immediate relief, working on improving your credit score is a long-term solution that can help you access better borrowing options in the future. Pay your bills on time, reduce credit card debt, and correct any errors on your credit report.

Explore Other Income Sources

In addition to borrowing, consider finding other ways to increase your income temporarily. This could include taking on a part-time job, selling unused items, or exploring freelance opportunities online.

Budget and Cut Expenses

Take a close look at your expenses and find areas where you can cut back temporarily. This can free up extra money to meet your financial needs without relying solely on borrowing.

Securing $5,000 quickly with bad credit is challenging but not impossible. By exploring alternative lending options, improving your credit, and making responsible financial choices, you can overcome the obstacles posed by bad credit and get the funds you need. Remember to carefully evaluate the terms of any loan and have a clear plan for repayment to avoid falling into a cycle of debt.